A Health Savings Account (HSA) allows you to save your money for current or future medical expenses that are not covered by your health insurance. A HSA is an account for people who have a high deductible health plan (HDHP). The HSA plan allows you to save money tax-free to pay for IRS-qualified medical expenses that the HDHP does not cover. After a year of saving, the money is yours to keep without any “use it or lose it” penalties. You may also earn investments on your HSA money for as long as it stays in the HSA account, and it will not be taxed.

You can open a HSA if you have an HDHP, a valid social security number, and a primary residence in the U.S. You also must not be covered by any other health plan, including Medicare, and cannot be claimed as a dependent on another person’s tax return (except your spouse).

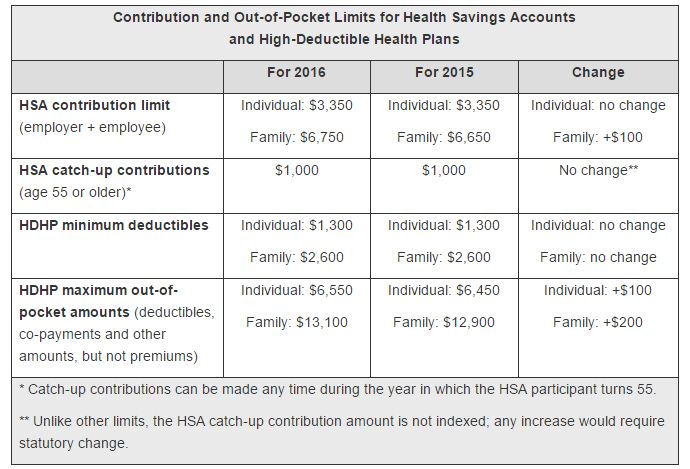

A comparison of the 2016 and 2015 limits is shown below: